Video KYC is an AI-based mechanism that ensures the customer’s credibility in the digital world and provides foolproof security that can prevent spammers.

KYC is a word used frequently in the banking business (Know Your Customer). The process or phase in which a customer’s profile is assessed is known as KYC. It assesses the risk of a bank’s or financial institution’s clients in order to guarantee that they follow anti-money laundering (AML) regulations.

Digital consumer identification verification is required in a variety of businesses, with the banking industry crossing with Fintech use cases. Video KYC is thus one of the most acceptable solutions for remotely verifying identification with the help of KYC specialists and technology as well as DIGITAL PAYMENT TRENDS.

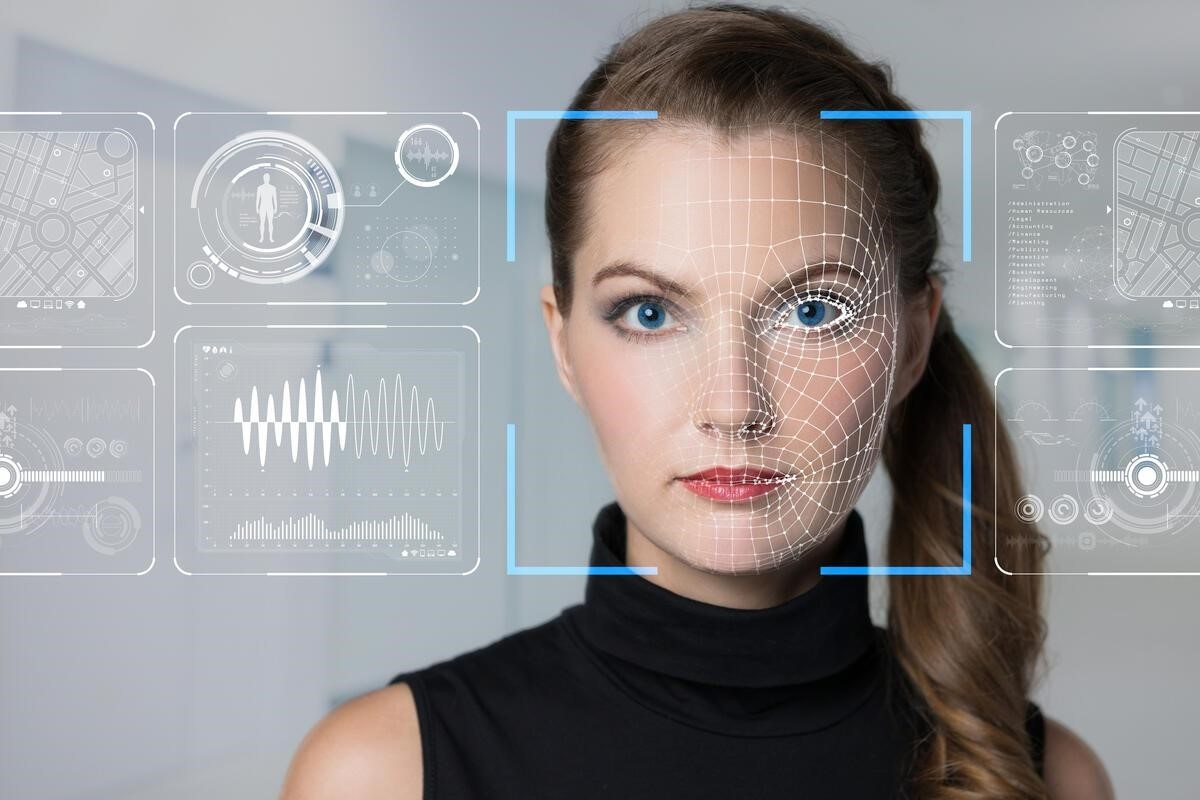

The notion of Digital KYC was born as a result of new technology like Artificial Intelligence (AI), Biometrics, machine learning, face matching, and recognition. Digital KYC, was able to overcome the challenges that the manual KYC procedure had previously encountered, although it still lacked comprehensive digitization. Video KYC is a popular technology that is assisting us in becoming totally digital.

KYC verification that is both digital and paperless

Video KYC is totally digital and does not require any paper. All three of the aforementioned Video KYC procedures take place through digital channels, rely on scanned papers or document pictures for verification, and may be conducted over the Internet.

Video KYC is a game-changer

V-KYC, or Video KYC, has also aided in the fight against COVID-19’s delay. Tools like V-KYC have provided banks the much-needed motivation to tide over the pandemic’s uncertainty, with the majority of people reducing face-to-face interaction. For a populace that expects instant access to the best answer to every problem.

A video KYC helps banks to complete customer KYC documents virtually, which gained traction following the Covid-19 epidemic, with banks and financial institutions speeding up their digital transformation efforts.

Advantages Of Video KYC

AI-powered Video KYC solutions and services can benefit a wide range of businesses, particularly in the financial sector. With the use of artificial intelligence (AI) and smart technologies, consumers may be onboarded quickly, effectively, and efficiently. Anytime and anywhere, flexible and feasible.

Completing a KYC online also expedites the application procedure for a savings account or loan, which might normally take several days. This procedure guarantees that you get the goods or services you require quickly. The entire procedure may be completed in a flash, saving both clients and banks valuable man-hours and resources.

Prevent Fraud

The number of business-to-consumer interactions on the Internet is steadily expanding. As the use of digital commerce grows, so does the demand for technology solutions to address the challenge of identity verification and how to build trust.

Fraud losses are on the rise. 63 percent of firms have reported the same level or an increase in online fraud in the previous 12 months. As a result of this expansion, there is a greater demand for rapid and simple verification methods.

Safe payment methods

Whether your company takes PayPal, credit cards, or both, you must be aware of any policies that may have an influence on your operations.

It makes good business sense to become aware of and implement the security precautions suggested by your payment service providers. This may be really helpful in terms of reducing fraud and increasing security.

A safe and secure environment

The procedure is also completely safe, so if you have any problems finishing it the first time, you can easily reschedule and have it completed again at no additional cost.

With the widespread use of digital technologies in practically every industry, video KYC in the digital payments industry is becoming increasingly important. Face verification, geo-location, document verification, and liveliness testing, among other features, make the procedure safe, secure, and easy for both sides. With Video KYC, you can get the best KYC solutions for your company.

Identity verification is completed more quickly.

Video authentication of customers’ physical visits for verification is no longer required using the KYC technique. As a result of remote verifications, the procedure is finished more quickly and without any delays.

Conclusion

Online Video Identity verification is a criterion that every bank and financial institution must meet when onboarding new customers. With the introduction of new digital services for consumers, these institutions must use technologically sophisticated verification solutions to combat the rising risk of fraud and money laundering.

With a rapid verification method that is compatible with their onboarding procedures, the video KYC solution provides greater security.